ri tax rate income

To receive free tax news updates send an e-mail with SUBSCRIBE in subject line. Subscribe for tax news.

For income taxes in all fifty states see the income tax by state.

. DO NOT use to figure your Rhode Island tax. Rhode Island Tax Table 2021 If Taxable Income - RI-1040NR Line 7 or RI-1040 Line 7 is. 2022 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Details on how to. Rhode Island Income Tax. Now that were done with federal income taxes lets tackle Rhode Island state taxes.

Terms used in the Rhode Island personal income tax laws have the same meaning as when used in a comparable context in the federal income tax laws unless a different meaning is clearly. DO NOT use to figure your Rhode Island tax. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

Rhode Island State Income Tax Forms for Tax Year 2021 Jan. Guide to tax break on pension401kannuity income. Rhode Island Income Tax Forms.

Compare your take home after tax and estimate. Rhode Islands 2022 income tax ranges from 375 to 599. The current tax forms and tables should be consulted for the current rate.

Discover Helpful Information and Resources on Taxes From AARP. Detailed Rhode Island state income tax rates and brackets are available on this page. The Rhode Island sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the RI state tax.

The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. More about the Rhode Island Tax Tables Individual Income Tax TY 2021 We last updated the Income Tax Tables in January 2022 so this is the latest version of Tax Tables fully updated. The Rhode Island tax is based on federal adjusted gross income subject to modification.

2021 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Rhode Island Income Tax Rate 2020 - 2021. Exemptions to the Rhode Island sales tax will vary by state.

The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. Ad Compare Your 2022 Tax Bracket vs. The table below shows the.

How Your Rhode Island Paycheck. For more information about the income tax in these states visit the Massachusetts and Rhode Island income tax pages. Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI tax rates of.

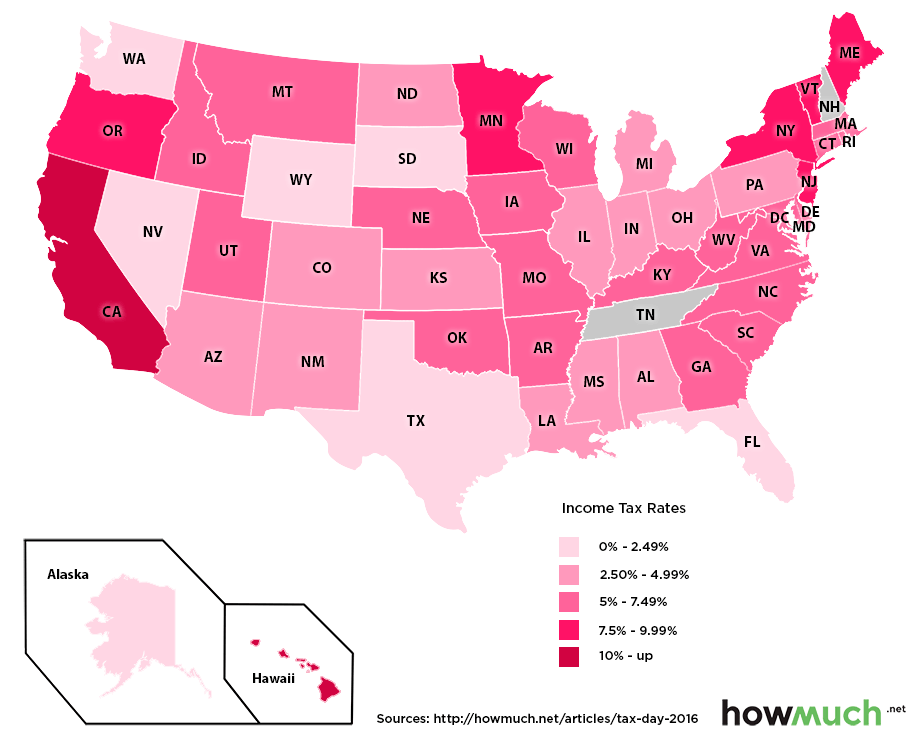

The state income tax rate in Rhode Island is progressive and ranges from 375 to 599 while federal income tax rates range from 10 to 37 depending on your income. Our Rhode Island retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401k and IRA income. Rhode Island also has a 700 percent corporate income tax rate.

Rhode Island has a. Residents of Rhode Island are also subject to federal income tax rates and must generally file a federal income tax return by April 18 2022. Rhode Island state sales tax rate.

The state has a progressive income tax broken down into three tax brackets meaning. Rhode Island state income tax rate. Rhode Island Tax Brackets Rhode Island uses a.

Though Rhode Islands property tax rates are high the state does offer some opportunities for exemptions and tax breaks. This page has the latest Rhode Island brackets and tax rates plus a Rhode Island income tax calculator. Rhode Island state property tax rate.

Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. Compare your take home after tax and estimate. T A X If Taxable Income - RI-1040NR Line 7 or RI-1040 Line 7 is.

Rhode Island income tax rate. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Census Bureau Number of cities that have local income taxes.

Instead if your taxable income. Rhode Island Income Taxes. The Rhode Island state income tax is based on three tax brackets with lower income earners paying lower rates.

Your 2021 Tax Bracket to See Whats Been Adjusted.

How Do State And Local Sales Taxes Work Tax Policy Center

Where S My Rhode Island State Tax Refund Taxact Blog

2022 State Income Tax Rankings Tax Foundation

Rhode Island Estate Tax Everything You Need To Know Smartasset

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Historical Rhode Island Tax Policy Information Ballotpedia

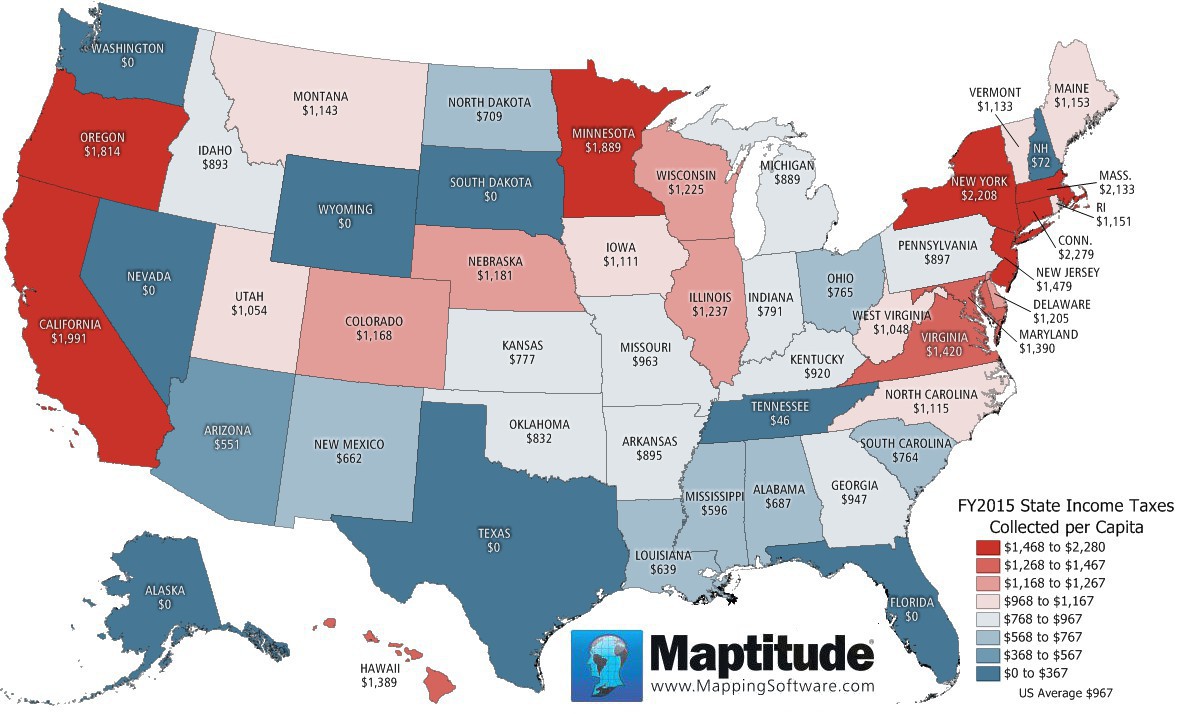

Maptitude Map Per Capita State Income Taxes

Rhode Island Sales Tax Small Business Guide Truic

Rhode Island Income Tax Calculator Smartasset

Rhode Island Income Tax Calculator Smartasset

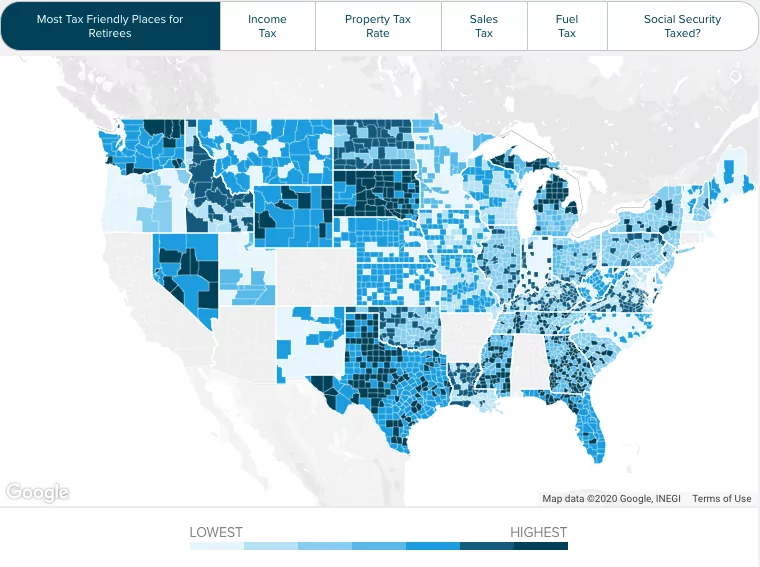

Rhode Island Retirement Tax Friendliness Smartasset

Which U S States Have The Lowest Income Taxes

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)